Welcome to the 1,016 new members (!!!) of the curiosity tribe who have joined us since Friday. Join the 35,181 others who are receiving high-signal, curiosity-inducing content every single week.

Today’s newsletter is brought to you by Tegus!

When I started to dive in on the global supply chain disruption, Tegus was my first destination—it’s a literal cheat code for my investment research and learning process. Tegus is the leading platform for primary research—a searchable database of thousands of instantly-available, investor-led interviews with experts on a wide range of industries, companies, and topics. It’s fast and cost-effective, enabling you to do great primary research without breaking the bank.

Special Offer: Tegus is offering a free 2-week trial to all Curiosity Chronicle subscribers—sign up below to level up your investment research game today!

Today at a Glance:

The ongoing global supply chain crisis is best viewed through the simple, Econ 101 lens of supply and demand.

Demand-side drivers primarily include unprecedented government support and economies roaring back to post-COVID life, both of which have driven up consumer spending on goods.

Supply-side drivers include Labor Shortages, Factory Shutdowns, Port Shutdowns, Flight Reductions, Container Ship Challenges, Infrastructure Deficiencies, and the China Energy Crisis.

Net-net, we have demand structurally higher and supply structurally lower, leading to delays, shortages, and rising costs across the value chain.

Supply Chain Apocalypse

By now, you’ve probably heard that global supply chains are in a state of disarray. You’ve definitely felt it—from attempting to order a new bike or sofa, or just trying to get a McDonald’s milkshake—as delays and shortages have spread across the world.

But if you’re like most people, you still have no idea how or why we got into this mess.

In an effort to fix that, here's a simple breakdown of what’s causing our ongoing supply chain apocalypse:

Background

There's a lot of talk right now about the global supply chain crisis.

To give you a sense of the drama here, consider the fact that Bloomberg—a traditionally less sensationalist media outlet—recently published an article subtitled “Inside the Brutal Realities of Supply Chain Hell”.

Before we walk through the causes, let’s talk about the effects.

What are some of the visible impacts of the crisis?

Product Delays: Good luck getting furniture, appliances, cars, or Christmas gifts before 2022.

Product Shortages: Many critical technology components (e.g. semiconductor chips) are in short supply.

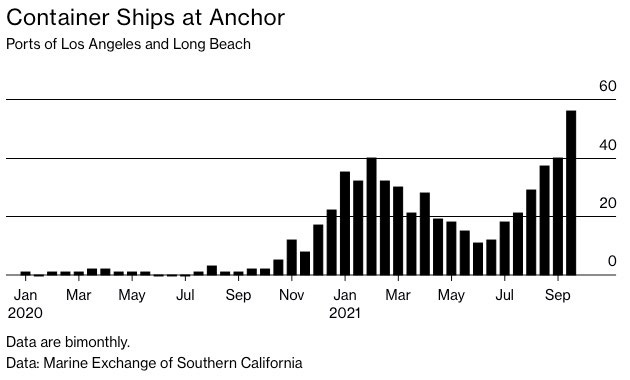

Port Buildups: The Los Angeles/Long Beach port has a historic backup that shows no signs of slowing down.

Rampant Freight Costs: The cost of shipping a container from China to LA/Long Beach has risen from under $1,000 pre-COVID to over $20,000 at times in 2021.

No exaggerations necessary—the effects are really quite bad.

But what is causing all of this?

Global supply chains are very complex. We live in a highly-interconnected world. A butterfly flaps its wings in Shenzhen and impacts when I receive my bike in New York.

Ok, maybe not quite, but almost...

To understand the drivers of the crisis, we need a simple framework. Let's break down what is happening using an Econ 101 classic: Supply and Demand.

Note: In this framework, supply will refer to everything related to manufacturing, production, and transportation, while demand will refer to everything related to consumption.

Demand-Side Drivers

First, demand.

This one is pretty simple—it's through the roof. Unprecedented government support (yes, the money printer did go “brrrr”) and economies roaring back to post-COVID life have created a strong demand environment. Consumers are flush with cash and not afraid to spend.

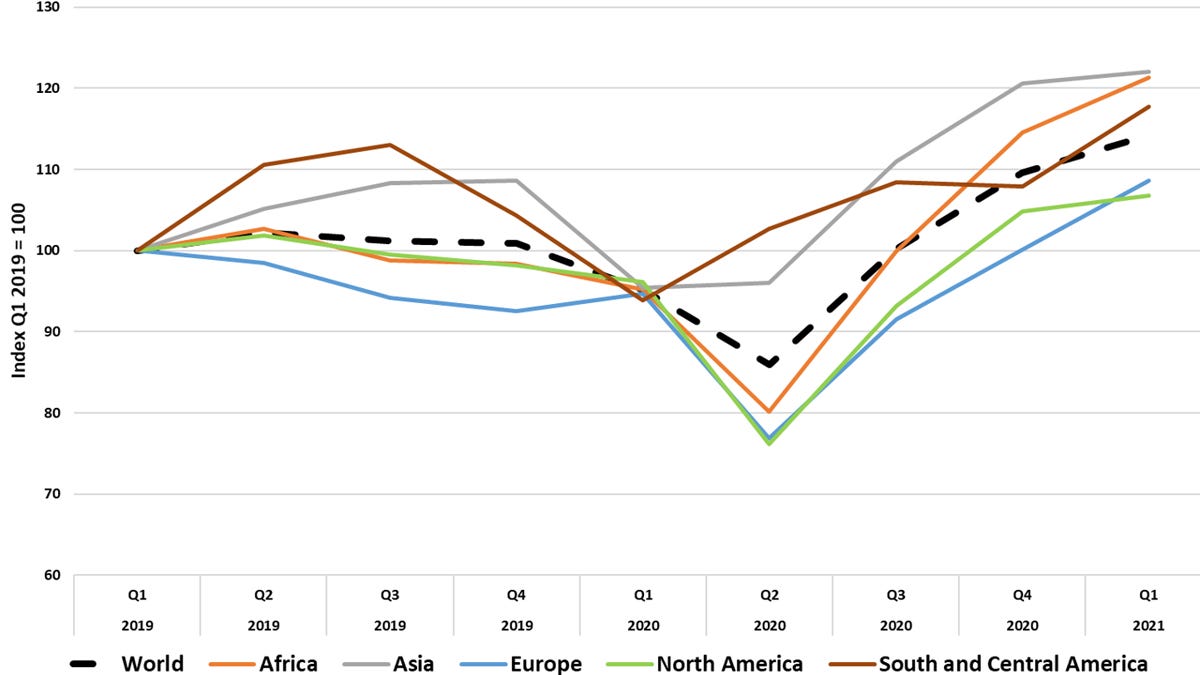

Furthermore, the early (and roving) lockdowns and restrictions have meant more spending on goods vs. services. The above chart of global exports shows the robust, sharp rebound from the COVID dip in 2020. Someone is buying all of these exported goods!

Supply-Side Drivers

Next, supply.

This one is more nuanced. The major supply drivers I see here:

Labor Shortages

Factory Shutdowns

Port Shutdowns

Flight Reductions

Container Ship Challenges

Infrastructure Deficiencies

China Energy Crisis

Let’s walk through each one in a bit more detail…

Labor Shortages

Labor shortages—at ports, in trucking and logistics, and in the manufacturing sector—are the first major supply disruption. Simply put, without efficient levels of labor in these areas, you have bottlenecks that start to slow the flow of goods through our global pipes.

Truck driver shortages are all over the news as of late. The U.K. even began offering thousands of visas to foreign truckers in an attempt to ease the pain.

COVID Factory Shutdowns

Factories—particularly in Asia—have had a tough time managing and containing outbreaks of COVID, leading to sporadic closures and shutdowns.

Nike and other large consumer brands have recently noted on earnings calls that they were forced to cut revenue forecasts and scramble to shift manufacturing due to shutdowns in Vietnam (an expanding manufacturing hub and beneficiary of Trump-era China tariffs).

The shutdowns create delays and bottlenecks in production. If an upstream manufacturer is delayed, that impact cascades downstream and has an extensive impact.

COVID Port Shutdowns

Ports have experienced similar challenges to factories—many have had to shut down or artificially restrict labor to avoid outbreaks.

In August, the Ningbo-Zhoushan port in China—one of the busiest container ports in the world—was forced to shut due to a COVID outbreak among the workers.

If ports are closed, products can't flow smoothly through the supply chain. Yet another kink in the hose causing the pressure to build.

Flight Reductions

It's news to most people, but about 50% of air cargo flies on passenger flights. It's a significant revenue stream for passenger airlines (and actually what allows passenger airlines to offer tickets at the cost they do).

But with travel—especially international travel—reduced by COVID, there was a significant reduction in air cargo capacity.

Some got creative, converting passenger planes into full cargo planes, but the net impact was a sharp decrease in air cargo capacity and a correspondingly sharp increase in air cargo prices (3x+ prior rates).

Container Ship Challenges

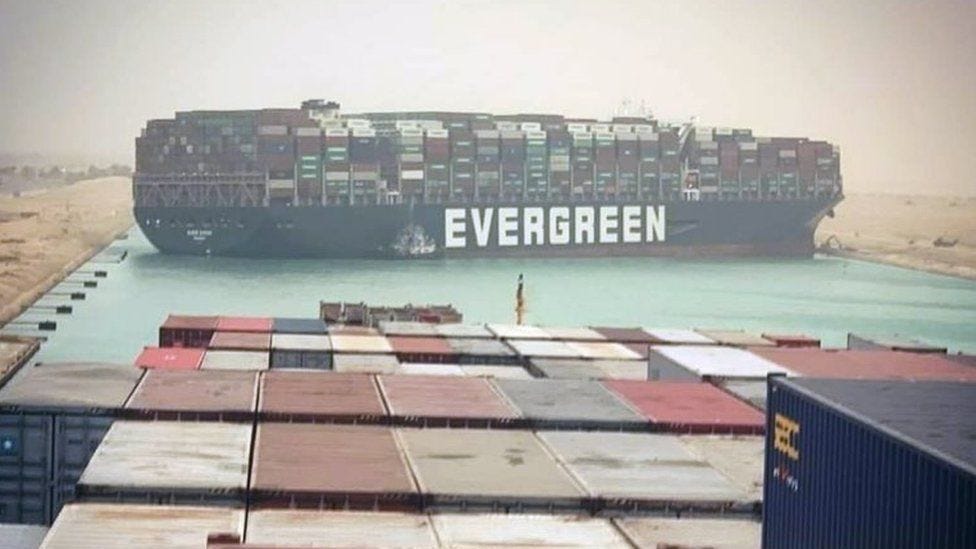

The Ever Given clogged the Suez Canal in March, causing a backlog whose impact cascaded through global supply chains.

There aren't enough large container ships to meet all of this demand and containers are in the wrong places at the wrong times.

Infrastructure Deficiencies

Physical infrastructure constraints are limiting the ability to shuffle/shift shipments around clogged ports.

Shipping companies have very few options—Los Angeles / Long Beach remains the only major West Coast port with the combination of trucking and railway infrastructure and proximity to population centers that enables efficiency at scale.

China Energy Crisis

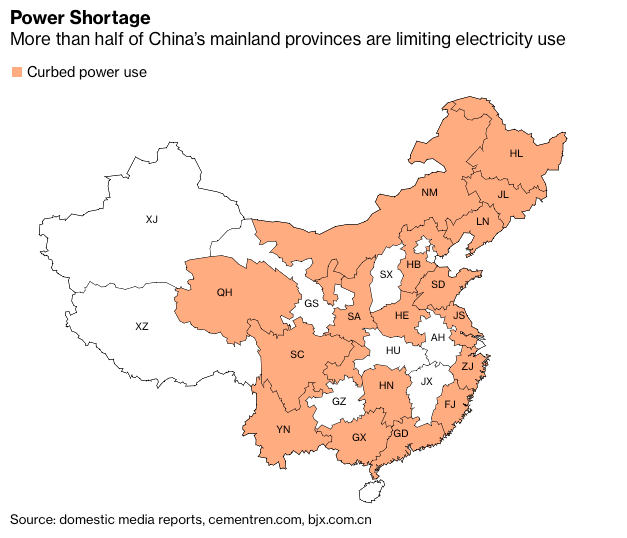

In the midst of everything else going on in the world, China is facing a burgeoning energy crisis, forcing them to cut electricity usage across the country.

The crisis appears to be caused by (a) local governments trying to avoid missing energy and emissions targets and (b) physical electricity shortages due to strained infrastructure.

It threatens to hamstring the manufacturing sector further, just as it tries to dig itself out from the aforementioned challenges.

Summing It All Up

So looking at all of this through my (admittedly) simplistic framework, here's what I see:

On one end, a structural surge in demand for goods.

On the other end, a number of significant supply challenges and disclocations.

Net-net result: Demand up, supply down.

Econ 101 tells us what to expect in that scenario: sharp shipping and production price increases, shortages, and massive delays.

For consumers, this means rising prices, as these rising supply chain costs are passed through onto your bill.

The Wall Street Journal said it best: Santa might be late this year…

The Supply Chain Apocalypse will undoubtedly continue to play out in public in the days and weeks to come. I hope this piece makes you feel more well informed on the causes of the crisis. Stay tuned for updates!

Sahil’s Job Board - Featured Opportunities

Free Agency - Sales Lead, Talent Agent for Tech (NEW DROP!)

Panther - Global Finance Lead, General Counsel (NEW DROP!)

SmartAsset - Acquisition Manager, Paid Search (NEW DROP!)

Practice - Head of Marketing (NEW DROP!)

Consensus - Lead Software Engineer (NEW DROP!)

Metafy - Senior Frontend Developer

Fairchain - Software Engineer, Full Stack

Skio - Founding Engineer ($50K REFERRAL BOUNTY!)

Commonstock: Community Manager, Marketing Designer

Scaled - Direct of Operations

Olukai - VP of E-Commerce

On Deck - Forum Director, CFO Forum, VP Finance

The full board can be found here!

We just placed a Head of Community, Growth Lead, Swiss Army Knife, Account Exec, and several other roles in the last month. Results for featured roles have been awesome! If you are a high-growth company in finance or tech, you can use the “Post a Job” button to get your roles up on the board and featured in future Twitter and newsletter distributions.

That does it for today’s newsletter. Join the 35,000+ others who are receiving high-signal, curiosity-inducing content every single week! Until next time, stay curious, friends!