The story of the last few weeks in finance has been the secretive rise and rapid downfall of Archegos Capital Management.

A thread on the underlying mechanics of the Archegos saga and how a $20 billion fortune vanished into thin air...

First, let’s set the stage.

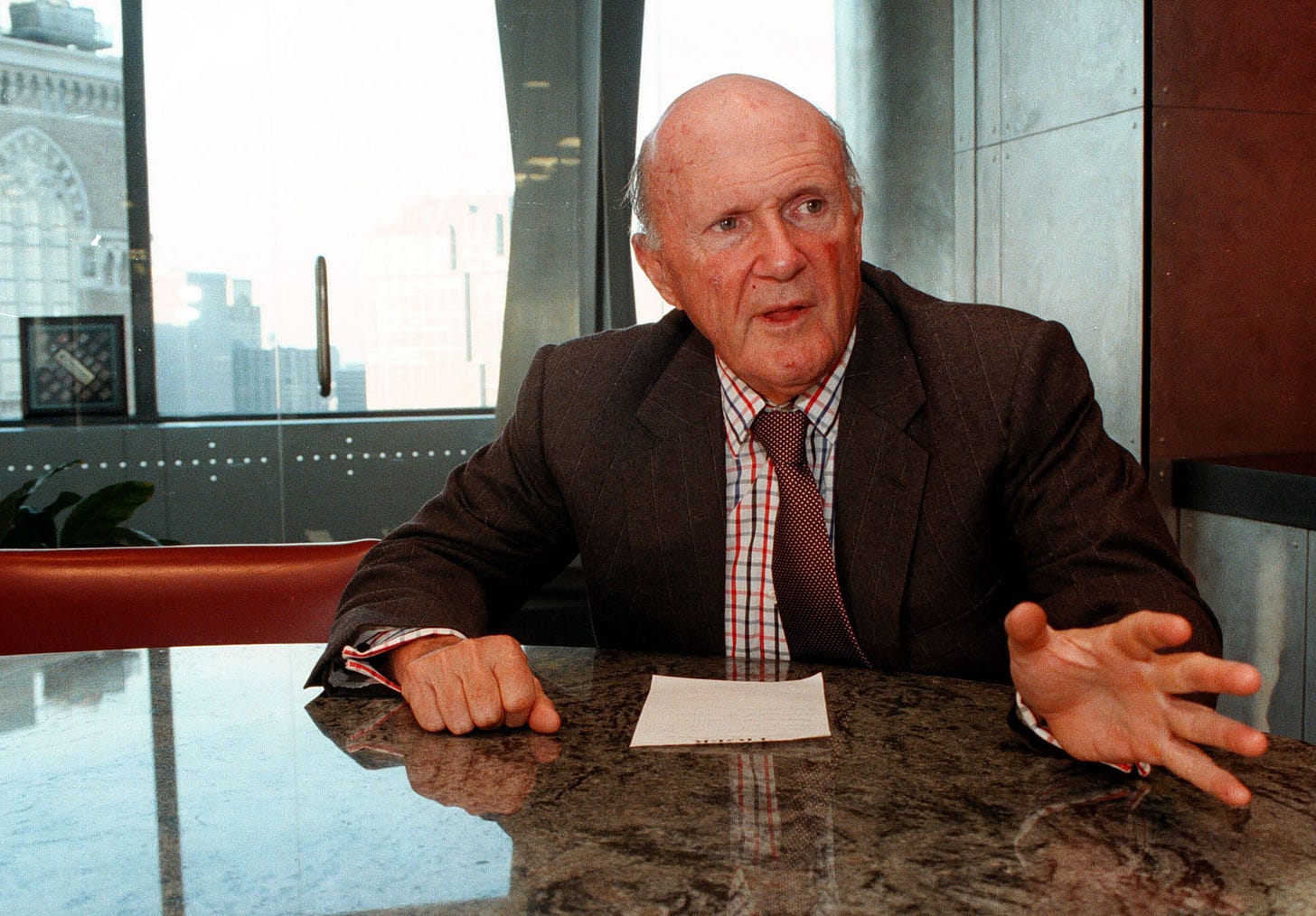

Archegos Capital Management is the family office of Bill Hwang, a former prodigy of hedge fund legend Julian Robertson.

Hwang previously built Tiger Asia Management - a so-called “Tiger Cub” fund due to its lineage from Robertson’s Tiger Management.

Bill Hwang grew Tiger Asia Management into a highly successful hedge fund, reaching ~$10 billion in assets under management in the 2000s.

He was a bit of an anomaly in the world of high finance - known as a devout Christian with simple tastes (seriously, he drives a Hyundai!).

After winding down Tiger Asia Management following a few bad bets and a run-in with regulators, Hwang opened Archegos (a Greek word for “one who leads the way”) in 2013 with ~$200 million in personal capital.

He began doing what he does best - trading and investing.

Going long innovation, he scored big wins on stocks like Netflix and Amazon.

Soon, Archegos’ capital had grown to $4 billion.

But Hwang, a private and deeply religious man, was not one for the spotlight. He just appears to have genuinely enjoyed his work.

Fortunately, there were features of the strategy that allowed the firm to remain anonymous.

As a family office, it was not required to disclose its holdings on a 13F filing (as with all hedge funds).

It used swap contracts to quietly amass large, leveraged positions.

The 13F loophole is self-explanatory: Archegos was a family office with a specific structure, so it did not have to file quarterly 13Fs disclosing its holdings.

Swap contracts (“swaps”) are a bit more complicated. Let’s simplify them here for everyone to understand...

In simple terms, a swap contract is an agreement between two parties to exchange (swap!) the values or cash flows of one asset for another.

Archegos entered swap contracts with banks to gain exposure to stocks without holding them.

This is not an uncommon practice for funds.

My banker buys $100 of Apple on my behalf but holds it on the bank B/S.

I post $20 as “margin” (see my primer on margin) and agree to pay interest on the borrowed money ($80).

I “own” $100 of Apple, but only had to put up $20 and no one knows I own it.

At the end of every day, we settle up on the account.

If the value of the Apple stock in my account rises, my banker pays me in cash the value of that rise.

If the value of the Apple stock in my account falls, I have to post additional margin (to make my banker feel safe!).

Note: I am definitely simplifying the mechanics of a swap contract for illustrative purposes. There are many types and flavors of swaps, but most follow the basic structure laid out above.

Back to Archegos...

Bill Hwang used swaps to amass large long positions (again, not an uncommon practice for hedge funds!).

He built positions in stocks like ViacomCBS, Baidu, and GSX.

He had accounts with many banks, including Goldman, Morgan Stanley, and Credit Suisse.

As the stocks rose rapidly in early 2021, he used the cash his swap contracts were paying him to enter new swaps, increase his leverage, and buy even more.

It was a self-fulfilling prophecy: rising prices enabled more leverage and more buying, further accelerating the rise.

At its peak, Archegos had built a ~$100 billion portfolio and Bill Hwang was worth ~$30 billion.

Importantly, as the positions were held at banks and not disclosed on 13F filings, the extent of the positions and leverage was largely unknown.

But then it all came crashing down.

On March 22, ViacomCBS, which had seen its stock 3x in the prior months (perhaps from Archegos’ aggressive buying) announced a $3 billion stock sale.

Its share price tumbled 30% in the two days that followed the announcement.

Suddenly, Archegos’ levered bets were underwater.

This meant that the value of the stock being held on the bank balance sheets was lower than the amount that was loaned to buy the positions.

The banks would be able to seize a portion of Archegos’ collateral in order to make themselves whole.

The banks allegedly asked Archegos to sell its positions and close the contracts.

This would mean Hwang would take a small loss but the banks would be whole.

The problem was that if the stocks dropped much more, Archegos would be wiped out and even the banks might take a loss.

The bankers from the different banks convened a meeting to discuss what to do.

Some believed the best path was to wait - the stocks would recover and everything would be fine.

Others weren’t so sure and began offloading large blocks of Archegos’ stock to mitigate their risk.

A classic deleveraging spiral was set in motion.

As the banks seized Archegos’ collateral and sold large blocks of the stock, the stock prices began to drop.

Seeing the further stock price drops, Archegos’ other bankers, who had been inclined to wait, began doing the same.

With the dust settled, it was time to assess the damage.

Archegos’ banks had offloaded ~$100 billion of stock.

Several (the late movers who had tried to wait) had lost billions in the process.

And Archegos had seen its estimated $20 billion capital base vanish into thin air...

The details of the Archegos saga are still unfolding.

It has many markers of a classic tale of Wall Street collapse, including excessive leverage, esoteric contracts, and epic losses.

But what may make the story more interesting is its lack of another classic marker: greed.

Bill Hwang does not appear to have been motivated by the accumulation of wealth or status.

His religious, charitable, frugal life is in direct conflict with the archetype of the Wall Street villain.

The complexity of his character adds to the mystique of this crazy story.

So that is the story of Archegos Capital Management, Bill Hwang, and how $20 billion was made and lost in the blink of an eye.

For more on Archegos and the dangers of leverage, check out this article from Bloomberg.

Enjoy this and want to share it with family and friends? You can find the original thread below. Subscribe now and follow me on Twitter so you never miss a thread.

Until next time, stay curious, friends!

Share this post